Experts in Web Applications. Web agency in Montreal-East.

Prositeweb puts its passion at the service of your success by offering you innovative and personalized digital solutions. Trust our expertise to propel your online presence to new heights.

Montreal web agency – Our web and application development services

We decomplex technological concepts to save you time and money

Welcome to the website of your web agency in Montreal-East, expert in websites and applications.

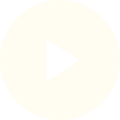

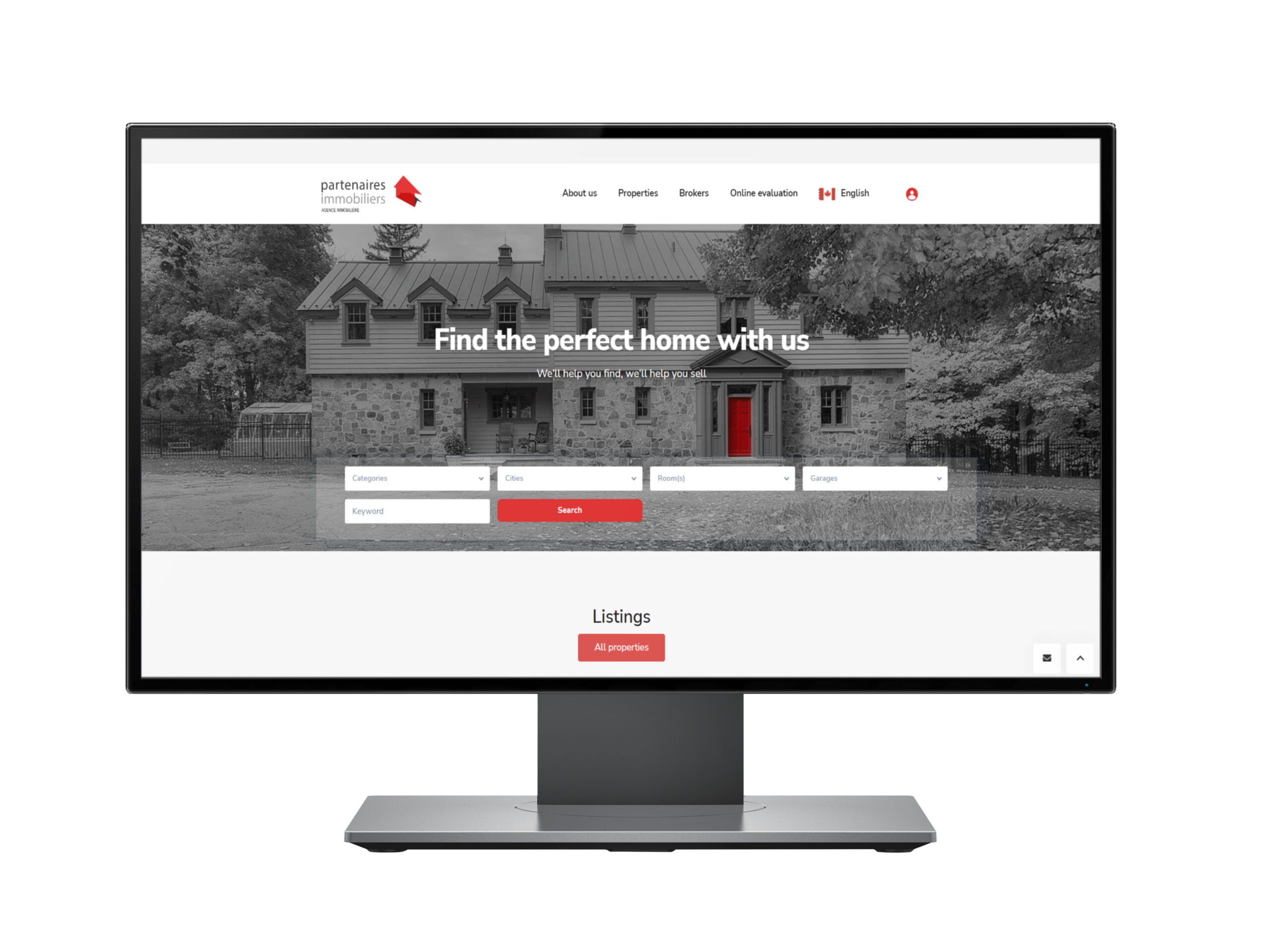

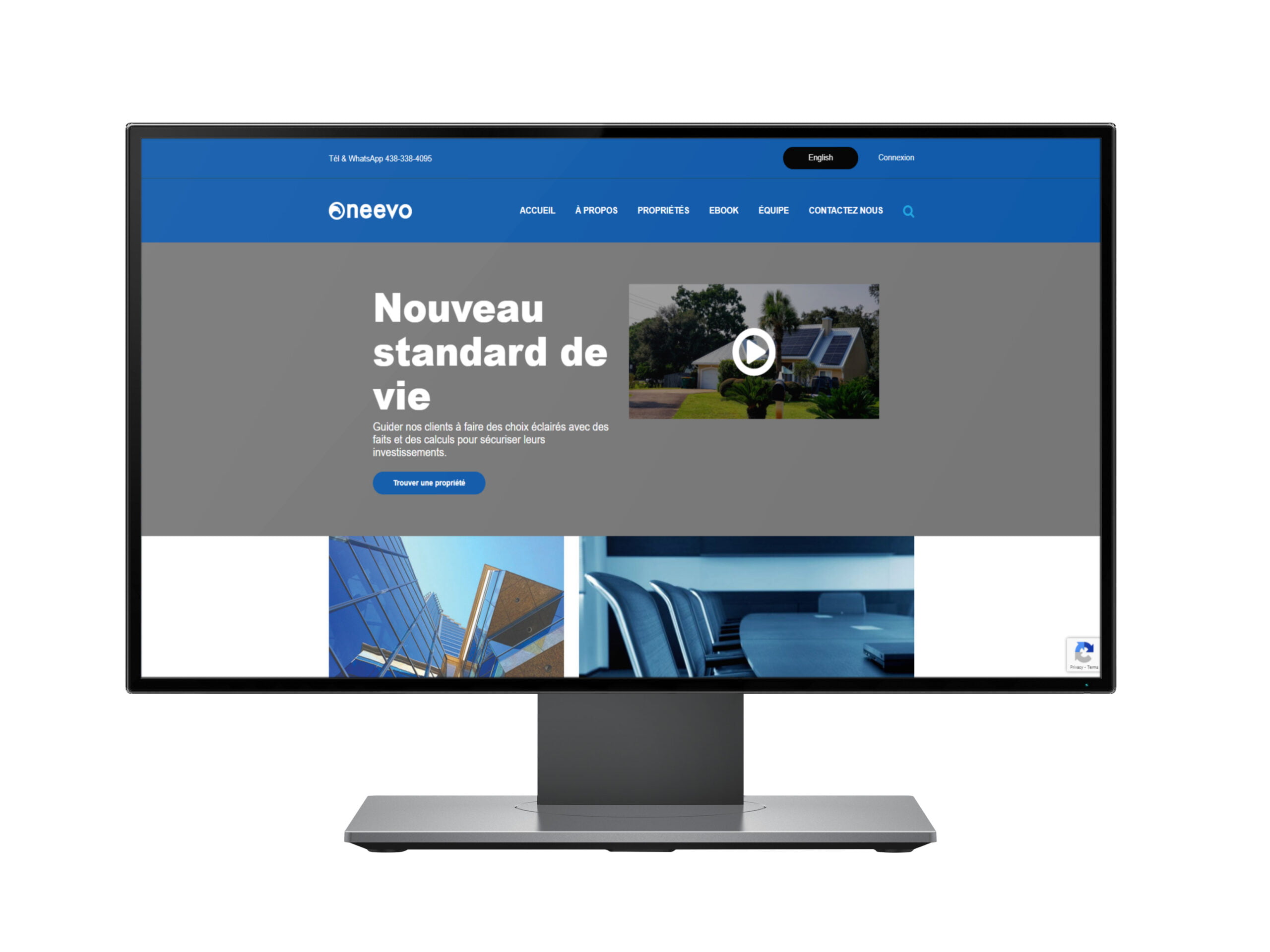

We are a web agency in Montreal-East, offering our clients a range of services in website design, creation of online stores, development of business applications. Founded in 2015, our mission is to provide businesses with turnkey solutions at competitive prices. We stand out for our advanced programming expertise and our ability to overcome technological challenges. If you are looking for a team for a long-term partnership, where technology is never a barrier, please contact us.

What customers say about us

Edgard You

Having worked with Prositeweb and Gilblas for a few months, I recommend it thanks to its responsiveness and expertise in development/Full Stack/Magento.

Martin Beaudet

At the beginning of 2024, we worked with Prositeweb, Gilblas and it was a real pleasure and success. It comes down to follow-up, communication and competence. This is what we are looking for when we entrust a personalized web mandate (API) like ours. Chapeau, Prositeweb, Gilblas, I recommend it and I will work with it again without a doubt.

Tchetcha Dany Jauresse

Prositeweb uses the latest technologies in website development and software. Also master e-commerce marketing.

Lucy Vannelli

Professional and very competent x

Frequently Asked Questions (FAQ)

What services does Prositeweb offer?

Prositeweb specializes in website creation, online store development, and business application design. Our agency is dedicated to the digital transformation of our clients' visions into tailor-made, efficient and autonomous web solutions.

What is Prositeweb’s philosophy?

Our philosophy is to provide fully tailor-made web solutions. Each project is considered unique, and we are committed to developing customized solutions that 100% realize our clients' vision, while minimizing dependence on external resources.

How does your web agency in Montreal-East integrate innovation into its projects?

Prositeweb stands out for its use of minicodes, internally designed resources that allow you to integrate features into your projects in a quick and adaptable way. This approach ensures efficient delivery and unparalleled adaptability to your needs.

What makes the Prositeweb team strong?

Our team is our greatest strength. Dynamic and with in-depth expertise in web solutions, we transcend technological limitations to offer solutions that exceed expectations. Our multidimensional mastery of web programming allows us to offer a wide range of services.

How long has your web agency in Montreal-East existed and what is its mission?

Founded in 2015, Prositeweb's mission is to provide businesses with turnkey solutions at competitive prices. We aim to overcome technological challenges with our advanced programming expertise, thereby standing out in our field.

Is Prositeweb open to long-term partnerships?

Yes, Prositeweb seeks to establish long-term partnerships with its clients, where technology is never a barrier. If you are looking for a dedicated team that can overcome any technological challenge, please contact us to discuss your project.

Do you develop modules?

Prositeweb is a web agency in Montreal-East that also has expertise in module development. We had the opportunity to create plugins that you will find on the WordPress.org website. On our solution page, you will also see some modules.